WHO’S YOUR DADDY?

On a Wednesday, the Washington State House Democrats released their plan to fund education with a capital gains tax. On Thursday, the radio ads denouncing the plan as an assault on Washington families began to appear.

At the hearing a few days later, the usual suspects lined up as you would expect: the folks from education, social services, and health care testified once again that we need to raise revenue for starved public infrastructure and do something about the most regressive tax system in the country, while the business lobbyists showed up to tell us that a capital gains tax would surely be the end of life as we know it.

But along with the Olympia regulars, there were also a handful of concerned citizens, people whose day job is not to testify in legislative committees, but who thought the issue was important enough to show up any way. Some were from the Nick Hanauer wing of the rich people’s caucus. They were among the few people well off enough of to actually be affected by a capital gains tax, and they said they would be happy to pay it, recognizing Washington’s desperate need for new revenue and a fairer tax structure. Others were regular people, none of whom would likely feel the bite of a capital gains tax, all of whom denounced the plan as an assault on Washington families, just like the radio ads.

Noticeably absent were the rich folks who don’t want to pay the capital gains tax. They’re probably the people paying for the ads. The ads that ominously claimed that the House Democrats have targeted 30,000 Washington families for ruin.

Here at the blog, we’re fully sick of this and all the other talk about families. If we have to listen to one more piety about how government must live within its current income, like a real family does, or one more distortion about how a capital gains tax will hurt Washington families, we’re gonna puke.

The citizens of Washington are not a family. And if we were, and state legislators were our mommies and daddies, they would probably be in jail, for having failed to provide for their children to go to school, utterly neglecting their mentally ill children, and allowing their really rich children to live rent-free while their poor children paid all the bills.

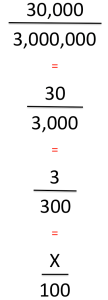

And it’s those really rich kids that would pay the capital gains tax. Thirty thousand families sounds like a lot until you remember that Washington has about 3 million families. And the one percent who would pay the tax wouldn’t even pay that much—1250 bucks for every 25 grand they make buying and selling stock. So if your portfolio made a million dollars one year, you’d have to make do with the $950,000 you’d have left after the tax.

The capital gains tax would pay for the schools that our parent legislators have neglected so badly they’re about to be thrown in the clink. Only rich people would pay it and they wouldn’t pay that much. And they wouldn’t pack up to leave to avoid it, because the eight other states that don’t have it aren’t the kinds of places that appeal to rich Washingtonians. A capital gains tax would be a small step toward making the most regressive tax system in the U.S. a little bit fairer. There’s really nothing bad about it.

That’s probably why the people who oppose it have to buy misleading ads that spew clichés about families to try to convince regular people to go testify against it.